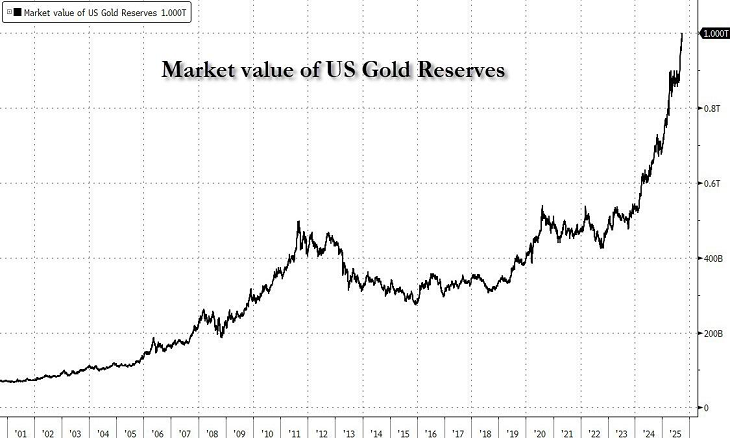

A dramatic shift is unfolding in U.S. fiscal symbolism: amid a relentless rally in spot gold prices, the value of the U.S. Treasury’s gold reserves has officially crossed $1 trillion for the first time — a figure more than 90 times higher than their recorded value on the government books.

This milestone has rekindled speculation that Washington may revalue (or “mark to market”) its gold holdings, a move that could unleash sweeping financial consequences for both the Treasury and the Federal Reserve.

The Surge Behind the Trillion-Dollar Threshold

The leap in gold’s value comes on the back of an explosive ~45% surge in 2025 alone, pushing spot prices into record territory. Once valued at a mere $42.22 per ounce (a figure set by Congress in 1973), the government’s 8,100-ton hoard is now worth nearly $1 trillion in today’s market.

However, these gains remain largely “on paper.” The gold is held by the Treasury, while the Federal Reserve holds gold certificates equivalent to that amount and credits the Treasury with cash in return. Because of this bookkeeping arrangement, officially revaluing the reserves would essentially move huge sums into measurable government assets — with major ripple effects.

What Would a Revaluation Do?

If revaluation were to occur, the Treasury’s assets would immediately swell, and so would its liabilities — in the form of gold certificates issued to the Fed. Meanwhile, the Fed itself would see its balance sheet inflate as those certificates become assets and corresponding liabilities (e.g. increased cash credits) are added.

In practice, the move could resemble a kind of “stealth QE”: new money entering the system without formal open market operations. Some analysts estimate as much as $990 billion could flow into Treasury coffers via this accounting alone.

But the implications are not benign. Injecting that kind of liquidity could stoke inflation, stretch monetary-fiscal independence, and further complicate the Fed’s balance-sheet management.

Resistance and Risk

Treasury Secretary Scott Bessent has already pushed back publicly on suggestions of revaluation. Detractors argue that marking gold to current prices would be “unorthodox” and could undermine both fiscal discipline and central bank credibility.

Furthermore, some economists warn that markets may view a revaluation as effectively admitting Washington is printing money by stealth. The risk: inflation expectations may shift, bond markets could rebel, and investors might demand higher yields to compensate for perceived monetary loosening.

The U.S. is not alone in having revalued gold — Germany, Italy, and South Africa have all moved their reserves to market value in past decades. Yet in the U.S., the entrenched separation between monetary and fiscal policy has long discouraged such a leap.

What to Watch Next

- Treasury signaling: Whether Secretary Bessent or the White House offers more clarity or hints of adapting accounting rules.

- Fed reactions: How the central bank would manage balance-sheet stress if the revaluation proceeds.

- Market behavior: Price movements in gold, bond yields, inflation breakevens, and investor sentiment.

- Congressional oversight: Whether lawmakers push to explore or block such a revaluation given its enormous implications.

Crossing the $1 trillion mark is more than symbolism. It reignites tension between optics and economics, accounting and reality — and sets the stage for one of the most profound financial maneuvers the U.S. may ever attempt.