In today’s fast-paced world of artificial intelligence (AI) and fintech innovation, businesses are discovering creative ways to scale faster. One of the hottest topics shaking up the tech and finance industries right now is the so-called AI Vendor Financing Infinite Money Glitch. While it may sound like something out of a video game, the concept is rooted in real-world mathematics, venture capital strategy, and AI-driven financing models.

This article dives deep into the stunning math behind this phenomenon, why it’s trending, and what it means for the future of AI startups, SaaS companies, and financial technology.

What Is the AI Vendor Financing “Infinite Money Glitch”?

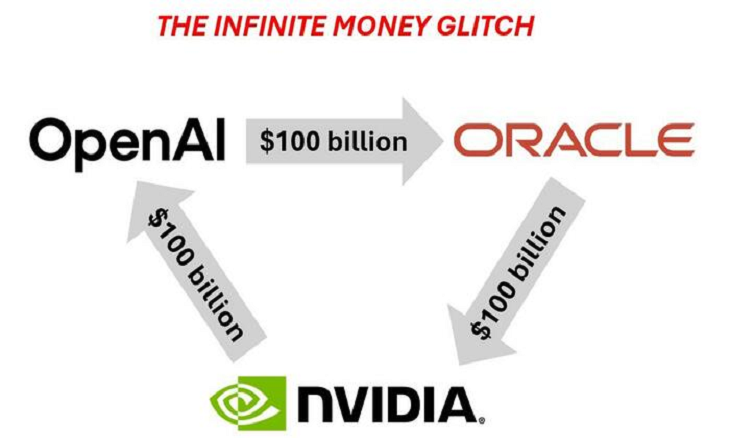

The AI Vendor Financing glitch refers to a financing loop that some companies exploit by leveraging vendor credit, AI-powered cash flow modeling, and recurring revenue projections. Essentially, companies can borrow against future revenue streams while using AI to optimize repayment schedules, interest rates, and capital allocation strategies.

When executed correctly, the math creates a cycle that feels like “printing money.” Businesses can reinvest borrowed capital into AI growth engines, generate new revenue, and then use those earnings to secure even more financing.

The Math Behind the Glitch

At the core of this strategy lies compound growth, recurring revenue models (ARR/MRR), and AI-enhanced predictive analytics. Here’s a simplified breakdown of the math:

- Vendor Credit Leverage

- A business secures $1M in vendor financing.

- Interest is structured at a manageable 5–7%.

- AI-Driven Revenue Forecasting

- Using machine learning models, the company projects 30% quarter-over-quarter revenue growth.

- AI tools reduce uncertainty by optimizing customer acquisition cost (CAC) and lifetime value (LTV).

- Infinite Loop Effect

- The $1M generates $3M in new ARR.

- That ARR justifies another $3M in financing.

- Reinvesting keeps the cycle spinning, creating an exponential growth curve.

This loop, powered by AI algorithms, predictive finance tools, and venture capital funding models, is what experts are calling the Infinite Money Glitch.

Why AI Makes This Possible

Without artificial intelligence, such a financing model would be risky. Traditional lenders rely on historical performance, but AI finance models can analyze:

- Customer churn predictions

- Cash flow optimization

- Market behavior forecasting

- Dynamic pricing strategies

By feeding real-time data into predictive systems, businesses gain unprecedented accuracy in forecasting revenue. This predictive analytics edge makes lenders more confident, opening the door to larger lines of credit and more aggressive financing strategies.

Benefits and Risks of the AI Vendor Financing Model

Benefits

- Faster Scaling: Startups can grow at lightning speed without waiting for organic revenue.

- Capital Efficiency: AI ensures optimal use of every dollar borrowed.

- Investor Attraction: Exponential growth creates hype, leading to higher valuations.

Risks

- Overleveraging: Companies can become trapped in debt if growth projections fail.

- Regulatory Scrutiny: Fintech regulators may view the “infinite loop” as risky financial engineering.

- AI Dependency: Flawed models or biased data can lead to catastrophic miscalculations.

The Future of AI and Financing

The AI Vendor Financing Infinite Money Glitch isn’t truly infinite—eventually, markets correct, growth slows, and debt needs repayment. However, the math shows how AI-powered financial strategies are rewriting the playbook for business growth.

As AI startups, SaaS platforms, and fintech companies continue to adopt these models, expect to see more headlines about businesses scaling from zero to billions in record time. For investors and entrepreneurs, understanding this math may be the difference between riding the next wave—or getting wiped out by it.

Final Thoughts

The stunning math behind AI vendor financing reveals more than just a growth hack—it highlights how artificial intelligence is fundamentally transforming finance. While the term “Infinite Money Glitch” may sound sensational, it reflects the new reality where AI, predictive analytics, and innovative financing converge to create exponential opportunities.

For businesses looking to compete in the AI-driven economy, the question isn’t whether to embrace these strategies—but how to do so responsibly, before the glitch turns into a crash.