Artificial intelligence (AI) is the hottest trend in technology and finance. From AI startups raising billions to cloud computing companies offering AI services, money is flowing into the sector at record speed. But behind the headlines lies a risky financing model that some analysts are calling the AI vendor financing “circle jerk” — a cycle where tech giants fund their own growth through clever, but questionable, accounting.

What Is the AI Vendor Financing “Circle Jerk”?

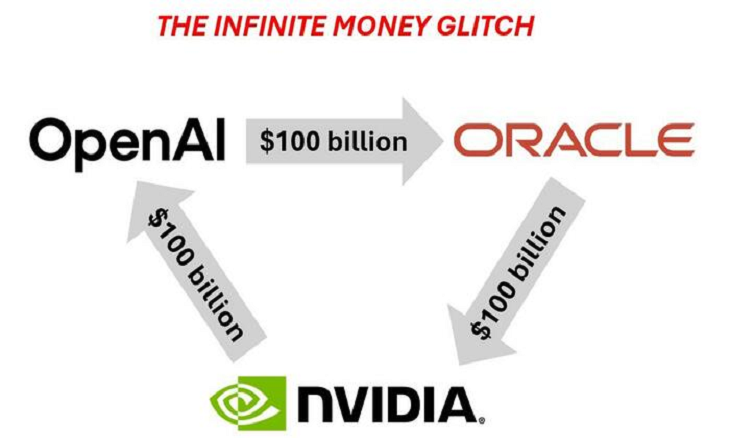

At its core, the vendor financing loop works like this:

- A big tech company (think Microsoft, Amazon, or Google) invests in an AI startup.

- That same startup then spends a large portion of the funding on cloud services or AI infrastructure provided by the investor.

- The tech giant can report both investment activity and revenue growth from the same deal, creating the illusion of organic demand.

In other words, money circulates in a closed loop — what goes out as an “investment” comes right back in as sales revenue.

This financial engineering creates an eye-popping growth story on paper, but the stunning math reveals that much of it is self-funded, not customer-driven.

Why the Math Looks Good — But Isn’t

On the surface, the numbers look spectacular. AI companies report triple-digit revenue growth, cloud providers announce record demand for GPUs and compute power, and investors see charts “going parabolic.”

But here’s the math behind the illusion:

- If a cloud giant invests $1 billion in an AI startup, and that startup spends $800 million back on cloud credits, the parent can report $800M in revenue gains.

- Meanwhile, the AI startup looks like it’s scaling rapidly — despite the fact that much of its “growth” comes from its own backer’s money.

- Both sides look like winners, even though no new external customers have been created.

This creates a feedback loop where valuation, revenue, and growth appear strong, but the cycle is internally funded — hence the term “circle jerk.”

The Dangers of Vendor Financing in AI

While this arrangement benefits both AI startups and cloud vendors in the short term, it comes with major risks:

- Artificial Demand: Growth fueled by recycled capital isn’t the same as real market adoption.

- Valuation Bubbles: Investors pile into AI stocks based on inflated revenue projections.

- Unsustainable Business Models: Once vendor financing stops, many AI startups may collapse under their true costs.

- Accounting Risks: Regulators may eventually scrutinize whether such circular transactions mislead investors.

This isn’t new — vendor financing was a red flag during the dot-com bubble, when telecom giants extended credit to startups who then spent it on network equipment. When the financing dried up, many companies collapsed overnight.

Why Big Tech Pushes the Cycle

For tech giants, the appeal is simple:

- Boosting Cloud Revenues: By “seeding” startups, they lock in years of cloud spending commitments.

- Controlling the AI Ecosystem: Investing ensures startups remain dependent on their infrastructure.

- Stock Market Hype: High growth rates in AI segments help push valuations higher and attract Wall Street attention.

It’s a strategy designed to maintain dominance in the $2 trillion AI market opportunity while keeping competitors out.

What Investors Should Watch

For investors eyeing AI stocks or cloud computing ETFs, it’s crucial to separate real growth from circular financing tricks. Here are some red flags:

- Startups that report massive growth but have few paying customers outside their primary investors.

- Cloud giants offering billions in “AI credits” alongside equity stakes.

- Revenue growth that slows dramatically when financing cycles pause.

If the math doesn’t add up, the growth story may not be sustainable.

Final Thoughts

The AI vendor financing circle jerk is one of the most stunning financial dynamics of the current tech boom. While it may create impressive headlines and temporary growth spikes, it also risks inflating a bubble that could burst when reality sets in.

For now, the numbers look unstoppable. But the real question for investors and industry watchers is this: when the financing merry-go-round stops, who will still be standing?