If you haven’t looked lately, used Rolex prices may surprise you. According to a recent ZeroHedge analysis, the secondary luxury watch market appears to have found a floor—and is now staging a recovery.

A V-Shaped Recovery in Watch Values

The Bloomberg Subdial Watch Index (tracking the 50 most traded watches on the secondary market) hit a trough in late January near $31,535. Since then, it has bounced back to $34,001—a 7.8 % rise from its low point.

Rolex models in particular saw a more pronounced rebound. Used Rolex prices bottomed around $10,964, but have now climbed to about $11,882, an increase of roughly 17.2 % since the bottom.

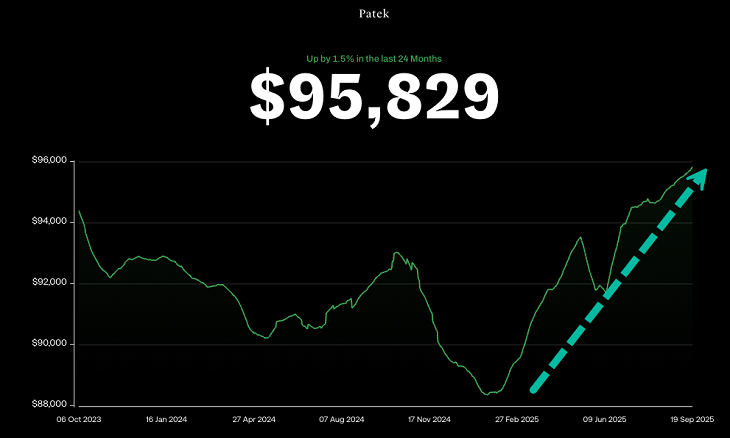

Patek Philippe timepieces have also followed a similar trajectory: from a low near $88,379 to a rebound to $95,829 (approximately 8.4 % gain) in recent weeks.

These gains challenge the narrative of a prolonged slump in the luxury secondary market, suggesting that demand—or at least buyer confidence—may be returning.

What’s Fueling This Upswing?

Several dynamics may be converging to reignite buyer interest in pre-owned luxury timepieces:

- Tariff-driven urgency: Trade tensions and import tariff threats have prompted some buyers to enter the secondary market early, anticipating price hikes in new Swiss watches.

- Signaling of a market bottom: Analysts and traders may view the January lows as a turning point—encouraging positions in assets seen as undervalued.

- Higher relative appeal: With new watch prices suffering under inflation or tariff pressures, secondhand watches may offer a more accessible entry point, especially for collectors and investors.

Still, some observers caution that the recovery could be tentative, particularly in the face of persistent interest rate headwinds and macroeconomic uncertainties.

Risks and Watchpoints for Investors and Collectors

While the rebound is intriguing, it comes with caveats:

- Volatility risk: Secondary watch markets can be subject to sharp swings, especially when sentiment shifts or macro conditions worsen.

- Liquidity constraints: Finding a buyer at a desired price may be tough—especially for niche or less popular models.

- Authenticity concerns: As prices rise, the risk of counterfeit or misrepresented timepieces increases. Verified provenance and service records remain critical.

- Interest rate sensitivity: The broader luxury and collectibles markets tend to respond to interest rate cycles. If tightening resumes or rates stay elevated, momentum may sputter.

The Outlook: Steady or Speculative?

If the recent recovery sustains, it may signal a more resilient secondary luxury-watch sector than some expected. For Rolex in particular, the sharper bounce suggests that it remains a bellwether name in the collector space.

Still, as ZeroHedge’s coverage implies, this rebound is only the early innings:

- The market may now test new resistance zones or rely on further catalysts (tariffs, macro policy shifts) to push momentum.

- A sustained rally might depend on broader confidence returning to luxury and alternative-asset classes.

- Watch investors, especially speculative buyers, should remain alert to reversal risk.

At present, used Rolexes—and luxury watches in general—may be entering a period of renewed attention. Whether this is a revival or a short-lived bounce remains to be seen.