Every few years, Washington finds itself in a budget standoff that leads to a U.S. government shutdown. Investors and everyday Americans alike wonder: what happens to the stock market during a government shutdown? Do stocks always go up, or does political uncertainty weigh on Wall Street? The answer is nuanced — and history offers important lessons for today’s investors.

Historical Performance of Stocks During Government Shutdowns

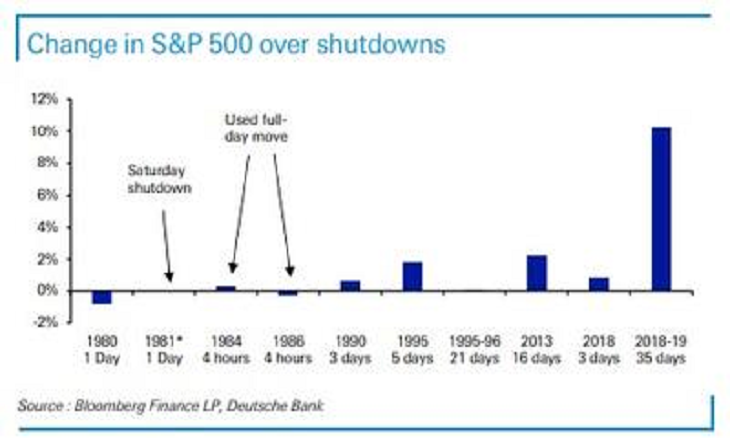

The U.S. has experienced more than 20 government shutdowns since the 1970s, ranging from a few days to several weeks. Surprisingly, the S&P 500 and other major stock indexes have often shown resilience during these periods.

Here’s what the data shows:

- Short Shutdowns (less than a week): Stocks typically see little to no long-term impact. The market tends to shrug off minor disruptions.

- Prolonged Shutdowns (over 2 weeks): Volatility increases as uncertainty builds, but historically, markets have often rebounded once a resolution is reached.

- Long-Term Trend: Despite shutdowns, the stock market has continued its upward trajectory, underscoring the idea that shutdowns are temporary political events rather than structural economic crises.

For example, during the 2018–2019 shutdown (the longest in U.S. history, lasting 35 days), the S&P 500 gained over 10%. Investors focused more on Federal Reserve policy and corporate earnings than political gridlock.

Why Stocks Sometimes Rise During a Shutdown

So why do stocks often hold steady — or even climb — when the government shuts down?

- Shutdowns Are Temporary

Markets know that shutdowns eventually end. Unlike recessions or financial crises, they rarely alter the long-term outlook for corporate profits. - Federal Reserve Policy Matters More

Interest rates, inflation, and monetary policy have a much stronger effect on stock prices than short-term political battles. If the Fed signals lower rates during a shutdown, stocks may rally. - Investor Sentiment & Bargain Hunting

Market pullbacks during shutdown news often invite buying opportunities. Savvy investors see political drama as a chance to buy quality stocks at a discount.

Risks for the Stock Market During Shutdowns

While stocks don’t always fall, shutdowns aren’t completely harmless:

- Federal Worker Furloughs: Consumer spending may dip if hundreds of thousands of federal employees miss paychecks.

- Delayed Economic Data: Key reports like GDP, jobs numbers, and inflation data may be postponed, leaving investors with less guidance.

- Credit Rating Concerns: Prolonged shutdowns tied to debt ceiling debates could spark fears of a U.S. credit downgrade, rattling markets.

- Sector-Specific Impacts: Defense, aerospace, and contractors tied to federal funding may see bigger disruptions than other industries.

Do Stocks Always Go Up During a Shutdown?

The short answer: No, not always. While many shutdowns have coincided with neutral or even positive stock performance, outcomes vary depending on other economic conditions.

- If the economy is strong and the Fed is easing, stocks may rise.

- If the economy is weak or inflation is high, shutdowns can amplify volatility.

- Global factors — such as oil prices, wars, or supply chain disruptions — often matter far more than political gridlock in Washington.

How Investors Can Prepare

For investors navigating a government shutdown, here are some strategies:

- Stay Focused on the Long Term: Shutdowns are political events, not economic fundamentals. Avoid panic selling.

- Watch Interest Rates: Fed policy has a greater influence on stocks than short-term government funding battles.

- Diversify: Holding a mix of stocks, bonds, and alternative assets can smooth out volatility.

- Look for Buying Opportunities: Temporary dips often create chances to invest in strong companies at better prices.

Final Thoughts

So, do stocks always go up during government shutdowns? Not always — but they usually recover quickly. Shutdowns create short-term noise, yet history shows that the U.S. stock market tends to look beyond political drama and focus on fundamentals.

For long-term investors, the key is not whether a shutdown will move stocks tomorrow, but whether strong companies and the economy will keep growing over the next decade. And on that front, history suggests the answer is yes.